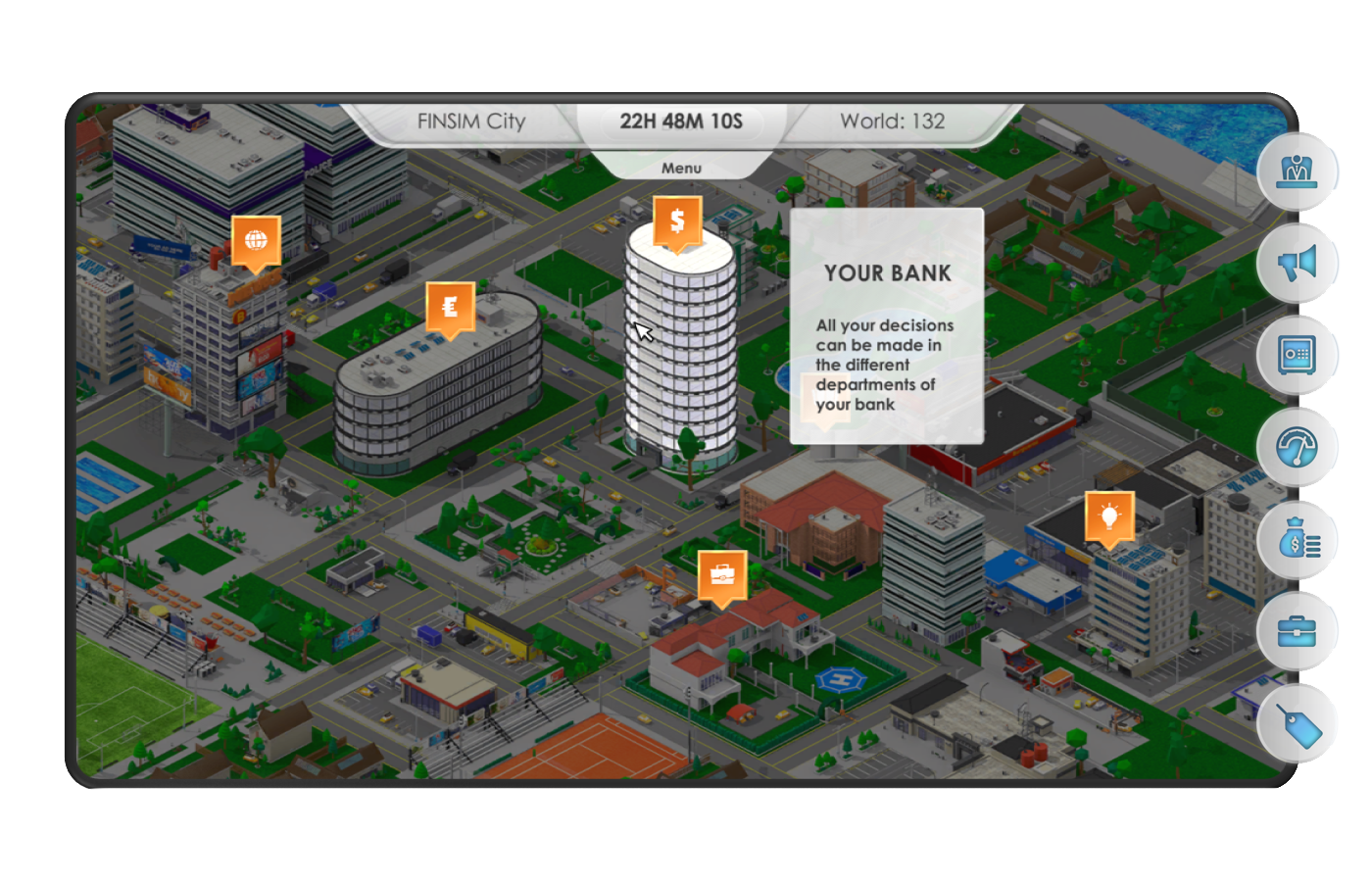

Finsim - Take on the role of the bank manager!

You are the CEO of a local bank. The Bank's performance - including strategic planning, business development, risk management, treasury, marketing and even sales channels - depends only on your decisions. Let the challenge begin!

A banking simulation game that shows real life bank management

Suitable for a variety of audiences from management to staff

Flexible training set-up: 1 or 2 days on-site or remotely online

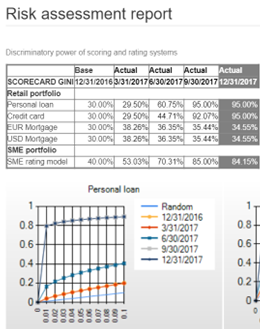

Real banking decisions (pricing, collateral, marketing, etc.), incorporating the latest Basel 3 and IFRS 9 rules

"Flexible modern technology that offers multiple game variations

We have played with more than 50 banks in the last 10 years

What will you learn?

Team-building

Through work within groups, communication between groups, and the search for consensus within the group.

Assessment of the effects of decisions

By confronting the results of the simulated bank, assessing the limitations of decisions and the optimal steps against competitors.

Identification with your own bank and its strategy

Through the presentation and discussion of the market situation of one's own bank, and awareness of one's own responsibility.

Getting to know the operation of the bank

Through real banking situations, simulation decisions and participating in discussions and presentations.

The FinSim training can be perfectly integrated into the bank's career programs and management development programs, because it promotes the transfer of the theoretical professional knowledge of the employees into practice. It provides a broad insight into various management-type decisions and the operation of the bank as a whole.

The training promotes communication between colleagues working in different fields, as well as a better understanding of each other's fields, and contributes to the participants being able to cooperate effectively during the decision-making process.

During the training, they have to make a total of 4 complex decisions, which apply to one quarter each. A report is prepared on the results of the decisions made, and by learning from the correct decisions and learning from the mistakes, you can make successful decisions for the next quarter.

In focus

- Liquidity planning and interest rate risk management

- Credit and deposit markets

- Strategic planning in a competitive market environment

- Credit risk management and regulatory capital

- Bank and product level profitability

In addition, you can learn about the use of interest rate and currency swaps, which enables the management of bank book interest rate risk and currency risk. You can also learn the basics of asset-liability management and bank liquidity planning.

The results:

leadership skillset

active teamwork

empathy and effective cooperation with partner areas

employees who experience bank management firsthand

The word "FinSim" is under national and EU trademark protection, registration number:

a) at the Hungarian Intellectual Property Office: 214 132,

b) at the EUIPO: 017937837.

CONTACT US!

Would you like to learn more about Finsim by ITCB (Bankárkéző) or try the simulation? Contact us directly to discuss your needs!